An insurance binder is a temporary proof of insurance coverage. Learn how it works, its role in auto, home, and commercial insurance, and why it’s essential for coverage confirmation.

Introduction

insurance binder is a temporary documents that provide proof of coverage until permanent policies can be issued. The binder is handy when immediate coverage is needed, such as for homeowners or auto insurance. It’s a document that guarantees your insurer will cover the items specified, even before your actual policy is issued.

The purpose of this article is to discuss binders. They will be discussed in detail, including how they are used in various types of insurance and when coverage may be needed immediately. This guide clarifies everything, whether you are looking for a temporary insurance policy or a proof of insurance document.

What are Insurance Binders?

An agreement , or binder, is an interim contract that exists between a policyholder and a company of insurance company. It is a confirmation that the insurer accepts the risk and will provide coverage. This binder serves as a contract provisional unti l an official policy is released. A binder contains binder information like the types of coverage and limits, as well as the Policyholder. information.

l an official policy is released. A binder contains binder information like the types of coverage and limits, as well as the Policyholder. information.

How to Use an Insurance Binder

There are a few reasons that you would need an policy bindaWhen you are closing on an important transaction, for example, when leasing a car or purchasing a home, you may have to prove that you’re covered even though your insurance has not been processed. The document could be delayed or make the process more complicated.

The Difference Between an Insurance Binder and a Policy?

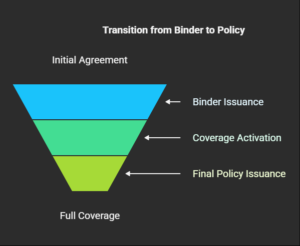

There are some important differences between a policy aaa binder. Both documents confirm insurance coverage. A policy binder has a temporary validity and is only good for 30-60 days. This is meant to provide you with proof of insurance until your full policy arrives. A formal insurance policy, on the other hand is a contr,, act which outlines all the details of the coverage.

Key Differences Between Insurance Binder and Insurance Policy

| Aspect | Insurance Binder | Insurance Policy |

|---|---|---|

| Duration | Temporary (usually 30-60 days) | Long-term (until renewed or canceled) |

| Function | Proof of immediate coverage | Official document with full terms |

| Details | Basic coverage information | Detailed coverage, exclusions, and limits |

| Use | Used in transactions like home buying, car leasing | Used for long-term coverage and claims |

| Binding | Binds the insurer to provide coverage | Binds the insurer with specific terms |

What are the different types of Insurance Binders?

1. Auto Insurance Binder

binder for auto insurance may be needed when immediate coverage is required, and often before the finalization of your policy. This binder provides temporary proofs of insurance which are essential for vehicle registration, road driving, and leasing.

Accordingly to the Insurance Information Institute III, nearly every U.S. State requires all drivers to hold a minimum amount of automobile insurance before driving.

2. Binder for homeowners insurance

A homeowner’s insurance binder can be used to refinance or purchase a new home. The lender will usually demand proof of insurance before closing the sale. Homeowners binder guarantees that you are covered as soon as you acquire the property.

99 % of mortgage lenders demand proof of home insurance to complete a loan.

3. Commercial Insurance Binder

Insurance binders are a must-have for any business. When you start a business or switch coverages, a binder will ensure that you remain protected. This binder is used to meet business requirements like workers’ comp or liability.

Insurance Binder Requirements: What You Need to Know

To obtain an insurance binder from the insurance provider, you will have to supply certain documents and details. This typically includes:

- Information Personal: The full name, the address, and all contact information of the insured.

- Details of the Types of Coverage.

- Effective Day: The date the binder comes into effect.

- Policy limits: the maximum amount of protection you receive.

- Premio Information: The amount of the premium and its payment method.

- Insurer details: The name of an insurance company or agent.

Proof of Insurance Binder: Why It’s Important

A binder that contains proof of your insurance is a good way to show you have coverage. The binder is especially important for situations where you may need to provide proof that your coverage includes:

- The closing of a house or car

- Rental car

- Get a Loan

- Participation in certain contracts of business

This proof of insurance is required to ensure that you can complete any important transaction. You can ensure that everyone knows you’re covered.

What is contained in an Insurance Binder?

The binder provides essential details about your policy to act as temporary proof. Details include:

- The name of the insured: who’s covered

- Types of coverage: Home, auto, commercial, etc.

- Limits of Policy: Liability, Damage, and other coverage limitations.

- Effective Date :

- Amount of Premium: the amount payable for Insurance

- Name of Underwriting Company :

- Binder No.: Unique identifier of the binder

How Long Does an Insurance Binder Last?

In general, a binder will last between 30-60 days. The length of time depends on what type of policy you have and how the insurer sets up their guidelines the policy is officially issued, it will be replaced by a permanent document.

FAQs About Insurance Binders

1. Why is an insurance binder necessary?

A temporary insurance binder serves as proof of protection until the insurance policy can be issued. This confirms to the insured that they have accepted the risk and are providing coverage.

2. How can I register my vehicle using an insurance binder?

Yes, a binder that contains auto insurance can be used for registration of a car until the policy is received.

3. Where can I find an insurance binder to help me with my policy?

You can request an insurance binder by contacting your insurance provider. Your insurer will ask for the information you need and then issue the insurance binder.

4. Can you cancel an insurance binder?

If you cancel the insurance policy early, or decide not to proceed with the binder for the policy can be canceled.

5. What is the legal status of an insurance binder?

A policy is a legal contract that guarantees. It is only temporary and is valid until the actual policy is issued.

Conclusion: What Insurance Binders Do You Need?

Binder: This document is essential for confirming your temporary insurance until you receive your policy. No matter if you want an Auto Insurance Binder, Homeowners Insurance Binder or Commercial insurance binder, you will have the document you need to ensure you’re covered when it counts. The document will allow you to move forward with critical transactions like home closings or contracts for business without delay.

When you understand the benefits and needs of an insurance binder, you’ll be able to make sure you get the protection you need. Request one as soon as you require it. Work closely with your insurance company to confirm that your coverage will be in place.

Click here to find out more about the Insurance Information Institute.