Discover the top 7 reasons why insurance for youth is essential for financial security, education, health, and future protection. Learn about health, auto, and student insurance options for young people.

Introduction: Why Insurance for Youth Is a Must-Have

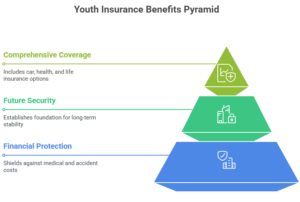

Youth insurance is one of the most prudent, financially wise decisions that young people and parents can make. It can help protect kids, teenagers, young adults, and adults from medical emergencies or accidents. It can also help with the financial burden of the future. Most people think that insurance only applies to adults; however, young people have risks as well, and the prices are often high.

Knowing the importance of insurance for young people as early as possible helps to establish an excellent foundation for future security. This can include car coverage, health insurance as well as student accident insurance, as well and life insurance for kids.

What Is Insurance for Youth?

Youth insurance includes different kinds of protection plans designed specifically for teens, minors, as well as young adults. They can cover:

- Insurance for health insurance for children

- Young drivers can get auto insurance

Insurance for student health insurance and accidents

Insurance for student health insurance and accidents- Life insurance for children

- Coverage for vision and dental insurance for youngsters

They help families avoid massive out-of-pocket expenses when injuries or medical emergencies occur. The policy also helps young people be in charge of their insurance requirements when they get older.

1. Health Insurance Protects Against Big Medical Bills

Young adults are sick, fracture bones as well, and require regular medical checks as do adults. Insurance for health insurance for minors can help to pay these bills. The policy also covers preventative treatment such as vaccinations and annual examinations.

If you don’t have insurance, an emergency medical situation that is minor could cost you thousands. If you have the right insurance plan,n families will be able to pay smaller co-pays rather than the full cost of medical bills.

| Plan Type | Covers | Typical Cost (Monthly) |

|---|---|---|

| Family Health Plan | Doctor’s visits, ER, prescriptions | $400-$1,200 |

| State Children’s Insurance | Affordable care for families with low incomes | $50-$200 |

| Private Pediatric Plan | Children’s coverage with specialization | $150-$500 |

Truth: According to the CDC, approximately 5 percent of the children living in the U.S. had no health insurance by 2023.

2. Auto Insurance for Teens Keeps Young Drivers Protected

First-time drivers are the most susceptible to being involved in crashes. It’s the reason teenage drivers’ insurance is mandatory and crucial. They help to cover the cost of damage to automobiles and medical costs in the event of a crash.

Teen drivers are often more expensive for insurance due to their high-risk behaviour. There are discounts available in the event of good grades, driving courses, and safe conduct.

| Auto Insurance Option | Best For | Monthly Premium Range |

| Parental Policy Add-on | Teenagers living in families | $100-$300 |

| Individual Teen Policy | Independent young drivers | $200-$500 |

| Teen Safe Driver Program | Teens who have a good record-keeping | $150-$400 |

Information: The Insurance Institute for Highway Safety (IIHS) states that teens are four times more likely to collision than drivers of older age.

3. Life Insurance for Children Builds a Future Safety Net

This may sound odd It may sound odd, it’s not, but child life insurance provides benefits that go beyond funeral expenses. It could help pay for the cost of education and medical expenses, particularly when it increases the value of cash.

The majority of families opt for these plans to secure low costs when their children are still young and healthy. Many policies have increased over the years and become a modest savings strategy.

| Insurance Type | Benefit | Policy Value |

| Whole Life for Child | Lifetime coverage and savings | $10,000 – $50,000 |

| Term Rider on Parent | Extra protection, short-term | $5,000 – $20,000 |

| Juvenile Policy | Coverage + cash value | $25,000 – $100,000 |

4. Student Health and Accident Insurance for Campus Safety

Health insurance for students will cover medical expenses during the time students are in university or live the campus. Most schools require proof of coverage or offer plans for campus students.

Students’ accident insurance protects against accidents arising from sports and school activities. It’s especially beneficial to student-athletes as well as active learners.

| Insurance Type | Coverage Includes | AAvg. Annual Cost |

| Campus Health Plan | Medical care, mental health | $1,200 – $2,000 |

| Student Accident Plan | Visits to the ER, sports injuries | $100 – $400 |

| International Student | Health emergency services, travel medical | $500 – $1,000 |

5. Vision and Dental Insurance Keep Kids Smiling

Exams for eye health and dental hygiene are crucial for developing children. Incorrect vision or a bad smile could affect their schooling and self-esteem. Dental insurance and vision for children help to make care accessible.

The majority of family plans and bundles of insurance for children include this type of coverage. In the event that they do not, standalone plans are offered.

| Plan Type | Covers | AvAvg.Monthly Cost |

| Pediatric Dental Plan | Cleanings, fillings, x-rays | $15 – $40 |

| Vision Insurance | Eye exams, glasses | $10 – $30 |

| Family Dental/Vision | Combo program for all family members | $30 – $80 |

6. Insurance for Youth Workers and Volunteers

Teens often work part-time jobs or volunteer. This can be risky, and a special insurance policy can safeguard them. Insurance for apprentices or insurance for youth activities will cover injuries at work or in gatherings.

Companies often purchase these insurance policies to safeguard the young people they serve as well as themselves from legal problems.

| Policy Type | Best For | Coverage Includes |

| Youth Volunteer Coverage | Church groups, NGOs | Accidents, liability |

| Part-time Work Insurance | Teen employees | Work-related injuries |

| Sports Team Insurance | Youth sporting clubs | Injuries, travel accidents |

7. Builds Responsibility and Financial Awareness

Instructing children about insurance early on helps to develop smart ways of thinking. They are taught to appreciate insurance, be prepared for the unexpected, as well as understand the importance of how to manage money. This helps them to make the right decisions if they have to get their insurance in adulthood.

Several schools and parent organizations have now included insurance education in Financial literacy courses.

The truth: A 2022 survey of Junior Achievement found that 61 percent of teenagers wanted to be educated about financial and insurance plans in the classroom.

Frequently Asked Questions (FAQs)

Q1: What’s the ideal age for life insurance coverage for a young child? The best time is when they’re healthy and young, typically less than age 10. The rates are the lowest at the moment.

Q2: Do students have health insurance required at schools?

Most colleges require it ;however, students can show evidence of another insurance plan when they already have an insurance plan.

Q3: Should I include my child in my car insurance policy?

Yes. It is usually cheaper than purchasing a separate policy, and also provides similar protection.

Q4 Do youth teams in sports require insurance?

Yes. Teams must have accidents as well as liability insurance to protect participants and the team organizers.

Q5: Do you know of discount rates for teenagers’ auto insurance?

Yes. A lot of insurance companies offer discounts on high results, safe driving lessons ,as well as a no-accident record.

Conclusion: Make Insurance for Youth a Priority

Finding insurance for your young ones is an effective method to shield youngsters from unpredictable twists and turns. From medical emergencies to automobile collisions, the right insurance will ensure that children or teens receive support whenever they need they need it. They also learn to be responsible and smart in the years to come.

If you’re a parent or an aspiring young adult, now is the opportunity to research the options for insurance and ensure your future in a healthy, safe way.

To find more useful information, check out Healthcare.gov to explore the options for health insurance for youth.