Explore the benefits of Karz Insurance in 2025. Learn about the best car insurance rates, affordable coverage, and compare options to find the best deals.

Karz Insurance: A Comprehensive Guide to Affordable and Reliable Coverage

Having car insurance is a must for every vehicle owner. If financing your car, your wallet, and your mind are all things you want to protect, then Karz insurance might be what you’re looking for! Be it someone driving for the first time or a person who has hit the road for years, knowing the ins and outs of how Karz insurance works and the best rates to avail can make your overall experience way easier.

Today, in this article, we will be discussing Karz insurance, how it is compared with the other one, and which factors need to be considered while choosing the best one for you. We will talk about everything from a cheap car coverage to an extensive insurance policy.

What is Karz Insurance?

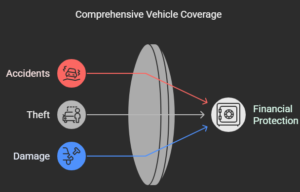

Karz insurance is vehicle insurance that protects you financially when you have an accident, theft, or damageto your car. The coverage is intended to protect against a range of risks, such as your car damage, damage to someone else’s property, and injuries incurred in an accident. It is essential to have the right coverage so that you are not stuck in a financial bind.

Karz insurance usually includes cover for third-py liability as well as damages caused to your car. Third-party insurance will help you when you fault ddamageother vehicles or property. Comprehensive insurance will cover many things that can be damaged in your vehicle.

How Karz Insurance Compares to Other Types of Car Insurance

When selecting the right car insurance, it’s essential to understand the different types of coverage available. Here’s a comparison between Karz insurance and other common types of car insurance policies:

Comparison Table: Types of Car Insurance

| Type of Insurance | Coverage | Pros | Cons |

|---|---|---|---|

| Karz Insurance | Combines comprehensive and third-party liability coverage. | Balanced coverage for your car and others. | May be pricier than basic insurance plans. |

| Third-Party Insurance | Covers damage to other vehicles or property when you are at fault. | Cheaper option for basic coverage. | Does not cover damage to your vehicle. |

| Comprehensive Insurance | Covers your vehicle for accidents, theft, and natural disasters. | Extensive protection for your vehicle. | More expensive than third-party plans. |

| Full Coverage Car Insurance | A combination of both third-party and comprehensive insurance, offering maximum protection. | Most complete protection available. | The most expensive option. |

As shown in the table, Karz insurance offers a balanced option that provides both third-party and comprehensive coverage, making it a great middle ground for drivers who need solid protection but don’t want to break the bank with full coverage.

The Benefits of Karz Insurance

There are a few benefits to having Karz insurance, which makes the insurance popular among the drivers:

- Cost-Effective Coverage: One of the attractive features of Karz insurance is its affordability. Many folks are trying to find ways to reduce their car insurance spending while still maintaining necessary coverage. Karz Insurance is a quick and affordable option.

- Broad Coverage: This insurance usually combines coverage against theft, accidents, and natural disasters. This makes it the top-tier solution for people who want to rest assured that their car is protected from nearly everything.

- Variety of discounts: Numerous Karz insurance suppliers can offer discounts as a consequence of becoming a decendriverst, multiple polices, or your vehicle acquiring specific security features. This allows for searching for a low-priced policy that is an ideal fit for your budget.

- Fast & Simple Quotes: Many car insurance companies will offer convenient online tools for you to get a quote. It saves the time you would spend comparing rates to find the one that suits you best.

Factors to Consider When Choosing Karz Insurance

What to look for when opting for the right Karz insurance?

- Your Driving History: A clean driving record helps you receive lower rates or pass on premium discounts.

- The type of vehicle: Your vehicle’s make and model, and how old your vehicle is, make a difference in your physics policy pricing.

- Coverage Limits: Confirm that the coverage limits are appropriate for your situation (like the worth of your vehicle and expected medical bills).

- Deductibles: Based on your budget, go with a deductible, as it directly influences your premium and the out-of-pocket cost when making a claim.

The Top Options for Karz Insurance

Here are some of the most common types of Karz insurance coverage to consider while looking at your options,

- Budget Car Insurance: The coverage might be low-cost, just make sure to compare providers.

- Affordable Car Insurance: Finding an affordable car insurance policy that does not skimp on coverage, like theft or personal injury, is not easy.

- Best Auto Insurance Quotes — Be sure to check a few quotes so you know what you’re in for when it comes time to pay.

- All-Round Car Insurance: An all-round car insurance covers a broad range, including theft and vandalism along with accidents.

- Third Party Car Insurance- This only offers coverage for the damages or injuries incurred by others due to your accident. Less protection but also cheaper.

How to Save Money on Karz Insurance

Even if you choose to take Karz insurance, there are ways to reduce your premium cost without compromising on coverage:

- Bundle policies: Insurance companies provide discounts for bundling car insurance with other policies (i.e, home and/or life insurance, etc.)

- Hit the Brakes on Savings: Cars equipped with better safety features like anti-theft devices or airbags can bring the rates down.

- So, avoid any moving violation, which is commonly known as a traffic rule violation. Drive carefully and acquire no annotations; ultimately, your premium will lessen in the long run.

- Select a Higher Deductible: This will save you premiums, but in the event of a loss, your out-of-pocket expense will be higher than it would be with a lower deductible.

Frequently Asked Questions (FAQs)

What is the difference between Karz insurance and full coverage insurance?

Complete coverage insurance usually consists of detailed protection as trending broad-based, and generally, Karz describes a substantial mix of these 2 insurance types. Karz insurance is typically less expensive than full coverage.

What can I do to obtain the best rates for car insurance for my Karz insurance?

For the best prices, canvass, compare rates from different companies, and avail of those discounts you may qualify for like a safe driver or those who bundle policies.

Is Karz insurance necessary?

Of course, come on, we’ve all heard of insurance, if you are trying to keep your money safe after some unlucky person wrecks your multi-purpose project bomber or drives around your house in the new “fresh” Palladian pickup. A good insurance policy, such as that offered by Karz Insurance, can help you avoid sudden, high out-of-pocket expenses.

With Karz insurance, am I able to reduce my car insurance premium?

Yes! Ask your insurer about discounts related to maintaining a clean driving record, keeping a higher deductible, and adding additional safety features to your vehicle.

How can you compare car insurance quotes?

Online comparison tools are the easiest way to compare car insurance quotes, provided you’re comparing like-for-like policies. Also keep in mind discounts as well as customer reviews management above the production decision.

Conclusion

With its on-point and indispensable concept, Karz insurance can be called a mind call of the insurance providers to balance out the expenditure of the drivers who wish to be fully covered with insurance without shelling out their whole bank account in the process. Karz insurance is a good option for cheap car insurance, or if you compare auto insurance quotes. You can avail of any option between third-party car insurance, comprehensive car insurance, along with available discounts, depending on your needs and budget. Also, however, do a comparison of the providers, have a look at the way you drive, or form protection that the most beneficial for you with the aid of considering your circumstances. A good driving history with the right policy can keep you and your car safe while driving around and provide you with peace of mind. To learn more about your options for car insurance, see this thorough guide on comparing car insurance costs.