Discover the impact of technology on auto insurance. Learn how telematics, AI, and smart policies are transforming the industry.

Introduction

The effect of technology on automobile insurance cannot be denied. In the last decade, technology has changed the way that insurance companies work and the interaction between them and their customers. The industry has undergone a major transformation. From auto insurance and usage based insurance to tracking driver behaviour as well as the integration of AI. The changes are not only improving the experience of the customers, but they also improve the efficiency, personalization, and security.

personalization, and security.

This article will examine how is changing the auto insurance industry and the key innovations that are shaping it. We will examine the impact of technology on auto insurance, from smart insurance policies through automated claim processing to Blockchain technology.

1. Telematics in Auto Insurance: Tracking Driving Behavior

Telematics for auto insurance is the term used to describe the devices that are installed in cars and collect data on the driving behavior of the drivers, including speed, brake patterns and driving habits. Insurance companies use this data to provide more customized rates, based on the driving habits of each individual.

Insurance providers can reward drivers who are safe by lowering their premiums using usage based insurance. Drivers who are responsible behind the wheel could save on auto insurance.

Progressive Insurance is a pioneer in the use of Snapshot, a device which monitors driving habits and rewards safe drivers. In the model of pay-as you-go insurance, drivers can adjust premiums according to their driving behavior. This is a more fair and customized method.

| Telematics Feature | Benefit | Example |

|---|---|---|

| Driver Behavior Tracking | Monitors driving patterns for safer driving rewards | Progressive’s Snapshot, Allstate’s Drivewise |

| Pay-Per-Mile Insurance | Premiums based on miles driven | Metromile, Nationwide SmartRide |

| Accident Detection | Detects crashes and can trigger the automatic claims process | OnStar’s Automatic Crash Response |

Telematics in Auto Insurance: What are the Benefits?

The incorporation of telematics by auto insurance providers allows for usage-based (UBI) insurance. This allows more accurate price models. Safety-conscious drivers get rewarded while more risky drivers might pay higher premiums. accident-detection technology embedded in telematics allows faster emergency responses and streamlines the claims process.

2. AI in Insurance Underwriting: Improving Accuracy and Efficiency

Artificial intelligence (AI) can play a key role in auto insurance. AI systems can process large amounts of data more rapidly than humans. They allow insurance companies to take better risk assessments and make pricing decisions.

AI can, for instance, process data from multiple sources, such as Credit Scores Driving Records and Social Media Activity. This allows AI to identify the risk profile associated with a driver. This automated Underwriting Process is not only faster, it’s also more objective and eliminates bias.

| AI Technology | Benefit | Example |

|---|---|---|

| Predictive Analytics | Helps predict claims risk by analyzing past data | Lemonade Insurance, Root Insurance |

| Automated Risk Assessment | Provides quicker and more accurate risk analysis | Geico, Allstate, Progressive |

| Machine Learning | Enhances pricing models based on data trends | Metromile, Travelers Insurance |

AI and Auto Insurance

AI has transformed underwriting, improving risk assessment accuracy and providing more customized quotes. Machine learning algorithms allow insurers to understand risks better and dynamically adjust their pricing models. Customers can get better rates, and the application process is streamlined.

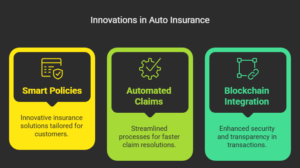

3. Smart Car Insurance Policies: Embracing the Connected Vehicle Era

Smart Car Insurance Policies are also a result of the technology impact on auto insurance. Insurance companies are able to offer smart car insurance policies because of the growing number of -connected cars.

Smart policies offer pricing that is dynamic based on driving habits, road conditions, the time of day and location. The connected car technology enables insurers to provide more accurate pricing, reduce fraud and improve the efficiency of claim processing.

| Smart Car Insurance Feature | Benefit | Example |

|---|---|---|

| Real-Time Tracking | Tracks location and driving behavior to offer personalized rates | Tesla Insurance, Nationwide SmartRide |

| Accident Detection | Uses vehicle sensors to detect crashes and file claims | OnStar, Allstate’s Drivewise |

| Remote Vehicle Diagnostics | Provides maintenance alerts and reduces breakdown risks | Metromile, Progressive Snapshot |

Smart Car Insurance Policies: They Work

Intelligent car insurance policy offers custom experience, by collecting data from your automobile. To illustrate, Real-time Driving Behavior data such as Speed Braking habits and Acceleration help insurers determine premiums based on the risk of an individual driver.

4. Blockchain Technology: Enhancing Security and Transparency

Blockchain Technology offers one of the most promising innovations when it comes to auto insurance . In addition to reducing paperwork, Blockchain helps streamline the claims processing by offering a secure decentralized ledger.

Auto insurance companies that use blockchain systems can generate transparent records. These records cannot be altered and improve trust between clients and insurers. This will ensure that transactions and claims can be handled securely and quickly.

| Blockchain Technology | Benefit | Example |

|---|---|---|

| Decentralized Ledger | Provides tamper-proof records for claims and transactions | InsurTech companies like Etherisc |

| Smart Contracts | Automates contract execution, reducing paperwork and fraud | AIG’s Smart Insurance Policies |

| Claims Transparency | Improves visibility of claims status and payment history | B3i Blockchain Consortium |

Blockchain’s role in auto insurance

Block-chain technology assists in the reduction of insurance fraud. It does this by allowing all parties to a claims process to monitor its progress in real time. intelligent contracts are also able to automate certain processes, such as the approval of claims, thereby eliminating delays and human error. This makes claim settlements more rapid and increases the security of data.

5. Insurance Fraud Detection Technology: Fighting Fraud with Advanced Tools

Insurance fraud can be a serious problem for car insurance companies. It costs them billions of dollars each year. Due to advances in technology, insurers can use Fraud detection Technology for identifying suspicious claims.

AI and advanced algorithms allow for the analysis of claims data in order to detect any anomalies and uncover patterns that may suggest fraud. These technologies allow auto insurers to reduce their fraud losses and, in turn, lower the rates of customers who are honest.

| Fraud Detection Technology | Benefit | Example |

|---|---|---|

| AI-Powered Claim Analysis | Detects fraudulent claims based on data patterns | Progressive, Allstate, Metromile |

| Real-Time Claim Monitoring | Analyzes claims as they are submitted to catch inconsistencies | Verisk’s Fraud Detection Tools |

| Automated Risk Detection | Flags suspicious activity without human intervention | IBM’s Fraud Detection Solutions |

How fraud detection technology helps the industry

AI-driven tools that detect fraud automatically identify suspicious claims. In turn, this reduces costs and speeds up the processing of legitimate claims.

6. Predictive Analytics in Auto Insurance: Forecasting Risk

Predictive Analytics are essential tools for car insurance companies to set up their pricing and assess risks. Insurers can forecast future claims using historical data.

This technology makes use of large datasets too to estimate the risk of an incident. In turn, this helps insurance companies better price their policies. To determine risk, predictive analysis can take into account factors such as driver habits, road conditions, and the weather.

| Predictive Analytics | Benefit | Example |

|---|---|---|

| Risk Forecasting | Predicts the likelihood of claims based on data trends | Lemonade, Allstate’s Drivewise |

| Dynamic Pricing | Allows for flexible pricing based on real-time data | Metromile, Progressive |

| Data-Driven Decisions | Enhances decision-making by utilizing historical data | Travelers Insurance, Liberty Mutual |

How Predictive analytics is changing the Business

Predictive Analytics allows insurance companies to make risk-based decisions that are more accurate by studying past behavior. This allows to be dynamically priced. Premiums will fluctuate depending on the data in real time, rather than fixed. Insurance becomes personalized, and more equitable for drivers who have good records.

7. Automated Claims Processing: Faster and More Efficient

automated Claims processing represents one of the most important benefits that technology has brought to the industry. Automation has sped up the claims procedure, making it quicker for drivers to recover compensation.

The AI technology and Machine Learning allows insurers to process and analyze claims in an automated manner, as well as communicate directly with repair shops. Not only does this reduce the costs of administration, it provides an improved experience to customers.

| Automated Claims Processing | Benefit | Example |

|---|---|---|

| AI Claims Handling | Automates claim submission and approval | Allstate, Progressive, State Farm |

| Damage Assessment | Uses AI to assess damage from photos or video | Lemonade, Travelers Insurance |

| Faster Payouts | Reduces delays in processing claims, leading to quicker payouts | USAA, Geico |

Claims Processing and the Future

With automated processing and an accurate claims approval process, it can be faster. AI-based tools will ensure that repairs and replacements are paid correctly.

FAQs about the Impact of Technology on Auto Insurance

Q1. Can AI increase my car insurance?

AI is able to help insurers establish fairer premiums based on data including driver habits, patterns of traffic, and vehicles history. AI may lower your premiums if driving is safe.

Q2. What exactly is telematics insurance?

Telematics is a type of insurance that uses data to monitor behaviors . These include speed, stopping, mileage, etc. This data may be used by your insurer to adjust the premium you pay in order to reward safe driving.

Q3. Can blockchain help to reduce car insurance fraud?

Is a blockchain-based technology that creates transparent, tamperproof records. It makes it hard for fraudsters and other malicious actors to manipulate the systems.

Q4. What are predictive analytics and auto insurance?

Insurers can use predictive analytics to forecast claims likelihood by analysing historical data. They can provide a more accurate price and improve risk management.

Conclusion

Technology is transforming the automotive insurance industry. This includes AI-driven Insurance, blockchain security, and other technologies such as usage-based Auto insurance. These innovations include telematics.

It will make auto insurance more affordable and easier to understand for both drivers and their insurers.

Discover more about Auto insurance. Visit this guide on auto insurance technology.